What is a loan tape?

A loan tape is a snapshot of a fintech's customer base and outstanding balances, as well as other information on customer characteristics (e.g., geography, industry, FICO scores, etc.) and risk profiles. In the context of fintech data and debt capital, you'll also hear loan tapes called servicing tapes, collateral feeds, and loan exposure tapes.

The term "loan tape" probably comes from the days of storing information on magnetic data tapes, more than 50 years ago. Sadly, while today's software systems are much more sophisticated, there's been little standardization over the last half century in how loan data is captured, stored, and exported. As a result, fintechs looking to export loan tapes or servicing tapes (for potential capital providers) during the capital raise process often find themselves creating data pipelines and loan schemas from scratch.

Today's loan tapes tend to live in CSVs exported from loan management or servicing systems, but we've also seen loan tapes come from CRMs or in-house systems of record. If you're starting or scaling a fintech, you know that the performance of your collateral is the key to the success of your business, but you've probably focused most of your time on customer acquisition rather than data standardization. So what goes in a loan tape, and what should fintechs expect when preparing loan tapes for capital providers?

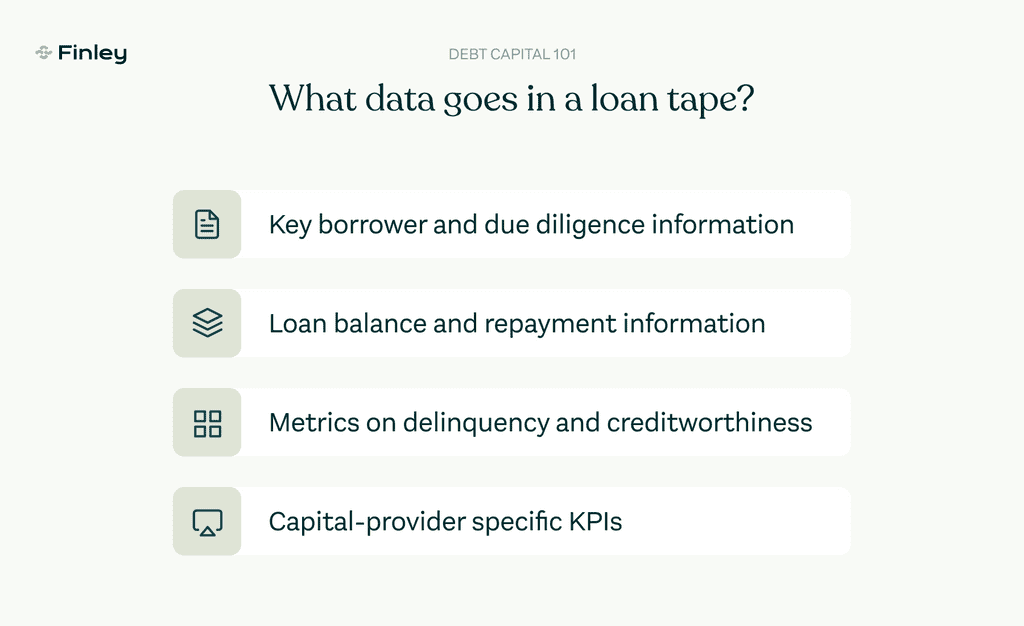

What are common loan tape fields?

Regardless of what type of fintech platform you operate, your loan tape or servicing tape will likely have one row for each of your customers (also called obligors) and a column that contains information on their balance or exposure. You'll also likely capture the timestamp of origination and the payback deadline(s), as this information is crucial for determining delinquency—another important field to make sure you include. That covers the basics, but knowing how much a customer owes and whether the customer is delinquent is only the first step in putting together a comprehensive servicing tape.

From there, you'll likely have to include a number of fields that relate to borrower characteristics. The data fields that fintechs use to assess customer creditworthiness are also the ones that capital providers want to see as they analyze and monitor collateral performance. These fields might include things like where a customer is based, what industry they're in, and their credit limit with the fintech. As we covered in our previous article on concentration limits, debt capital providers want to make sure they have an accurate sense of portfolio risk both within and across their debt capital borrowers. That starts with getting as comprehensive of a view of fintech platform performance as possible, during the diligence process.

After you've set up your loan tape export to include your basic customer and servicing information, you may also have to include fields that capture performance KPIs over time (i.e., derived fields). For example, capital providers may ask to know the average credit utilization of each of your customers (perhaps over the last 30 days).

Why are loan tapes important for raising and managing debt capital?

Putting together a clean, comprehensive loan tape or servicing tape is an essential first step for fintechs seeking to raise debt capital or acquire term sheets from capital providers (you can find Finley's Consumer Loan Tape Template here). To prepare an initial loan tape, fintech finance teams and ops teams often need to set aside time ahead of a debt raise to work with their engineering teams on a repeatable data export and validation process. These teams should also anticipate requests for additional information or alternative calculations of key data fields as the debt raise progresses.

After raising debt, fintechs will need to be able to produce loan tapes on a regular basis (generally daily) if they want to be prepared for draw requests (which require up-to-date collateral reports) and regular capital provider compliance reports (e.g., monthly financial reporting).

Where can I find a loan tape template?

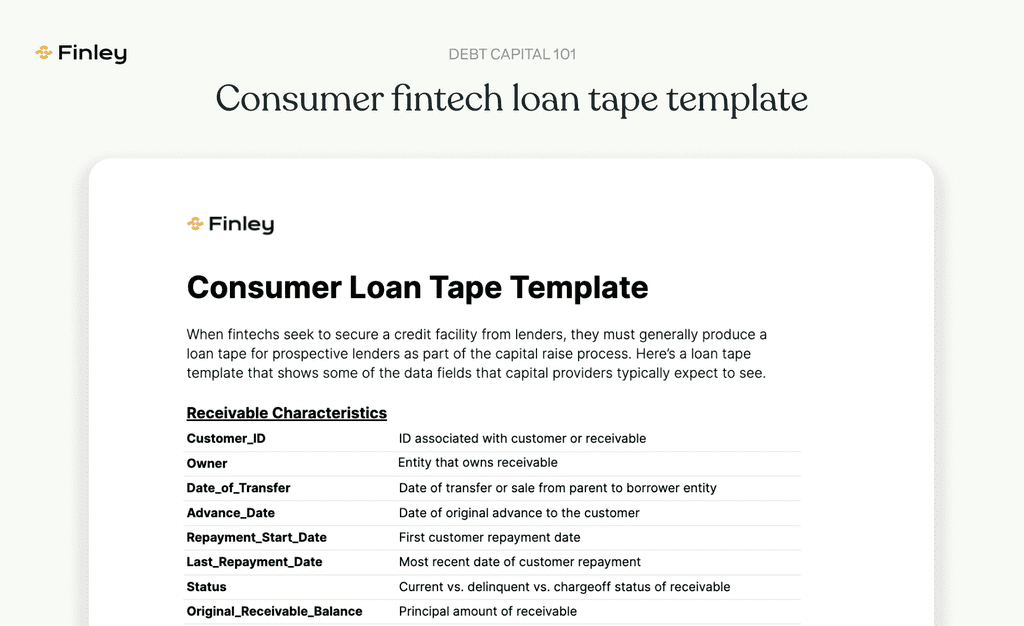

When fintechs seek to secure a credit facility from lenders, they must generally produce a loan tape export for prospective lenders as part of the capital raise process. To view a loan tape template that shows some of the data fields that capital providers typically expect to see, download Finley's Loan Tape Template PDF here. We put together this data tape template based on conversations with hundreds of lenders and dozens of borrowers, and we believe it captures most, if not all, of the fields that you'll be asked to provide during the debt capital raise process.

As you can see from the PDF, loan tapes contain both receivable characteristics and customer characteristics. Examples of receivable characteristics include a customer ID, repayment start and end dates, amount outstanding, and remaining term. Examples of customer characteristics (for a consumer fintech) include cohort, geographic, and credit score information.

While your loan tape won't look identical to the template file, you can use Finley's consumer loan tape template to get a sense of any gaps in your current data availability or reporting capability. A consultation with our team of debt capital data experts can also help you identify the best loan tape format for your specific capital markets needs.

Want to learn more?

Putting together a comprehensive loan tape or servicing tape is an important first step in raising debt capital. After you've successfully raised debt capital, though, you'll need to provide an updated loan tape or servicing tape each time you want to draw from your credit facility or prepare regular reporting for your capital provider. If you're interested in learning more about software that can help you streamline your debt capital raise and management, just schedule a demo, take a self-guided product tour or watch our 60-second product walkthrough below.